Cook County Board of Review Tax Appeal Seminar

Tuesday, October 17th at 6:00 pm

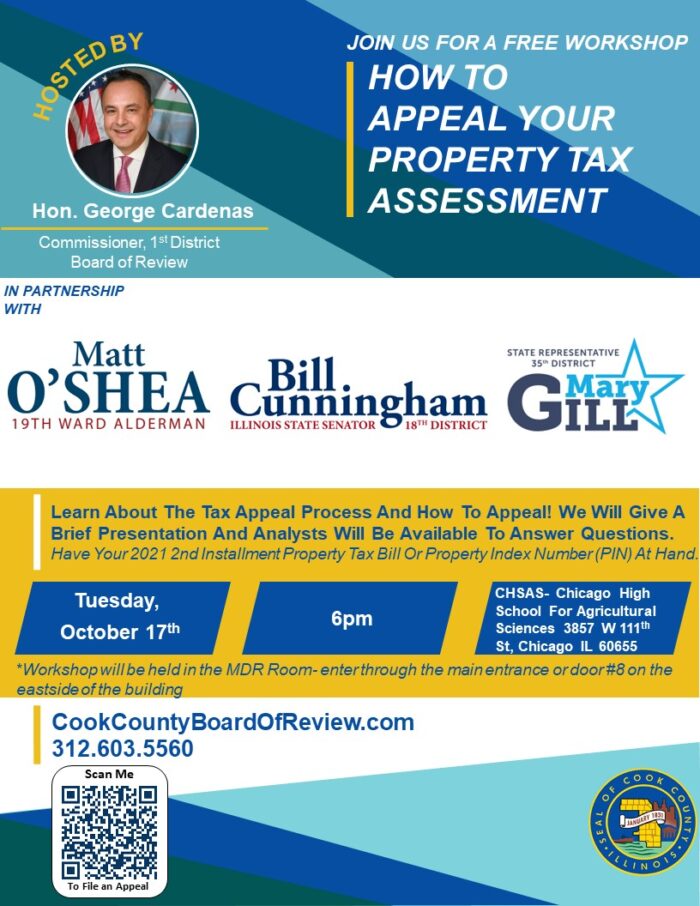

Cook County residents have a unique opportunity to tackle their property tax assessments head-on at an upcoming property tax appeal seminar. Co-hosted by Alderman Matt O’Shea, the event will take place on Tuesday, October 17th at 6:00 pm at the Chicago High School for Agricultural Sciences, located at 3857 W 111th St, Chicago, IL 60655. Alongside the Alderman, Board of Review Commissioners Larry Rogers, Jr., and George Cardenas will be present to lend their expertise.

Property taxes often pose a significant financial burden for homeowners, prompting the need for a better understanding of the assessment process. With this in mind, the upcoming seminar aims to simplify the complexities and empower residents to navigate the system with confidence.

At the Cook County Board of Review Property Tax Seminar, attendees will have the unique opportunity to learn from seasoned experts with extensive experience in property assessment and taxation. Commissioners Larry Rogers, Jr., and George Cardenas are eager to address questions and concerns from homeowners, ensuring they gain insights into the assessment process.

The seminar’s agenda covers crucial topics such as property assessment procedures, factors influencing tax calculations, common assessment mistakes, and the appeal process. Equipping property owners with this knowledge is vital in ensuring fair and accurate tax evaluations, ultimately resulting in potential cost savings.

In addition to invaluable insights from experts, the event facilitates direct engagement between residents and local officials. Commissioners Larry Rogers and George Cardenas are committed to serving the community and welcome feedback and concerns from taxpayers. This open communication fosters transparency and understanding, strengthening community bonds.

Residents are encouraged to bring their property tax bills or property index numbers to the meeting. This will allow them to complete and submit appeal paperwork on-site if they believe their property tax assessments are inaccurate or unjust. The appeal process offers homeowners a chance to rectify errors or present evidence supporting a reassessment, promoting equitable distribution of tax burdens.